27 Feb 2024 10:30 Handling results

Geopolitical and economic challenges weighed on throughput in all North Range ports in 2023. The declining development of the German economy and the subdued consumer sentiment also affected the business of Germany’s largest all-purpose port. In 2023, container throughput declined in comparison to the previous year, although a slight recovery occurred in the second half of the year. Bulk cargo throughput, however, remained largely stable, ensuring a consistent supply for Germany's economy. There was a positive development in trade with several American and Southeast Asian countries. Compared to its northern European competitors, the decline in containerised cargo in Hamburg was less pronounced, allowing the Port of Hamburg to maintain its market share.

Strained economic situation affects cargo throughput

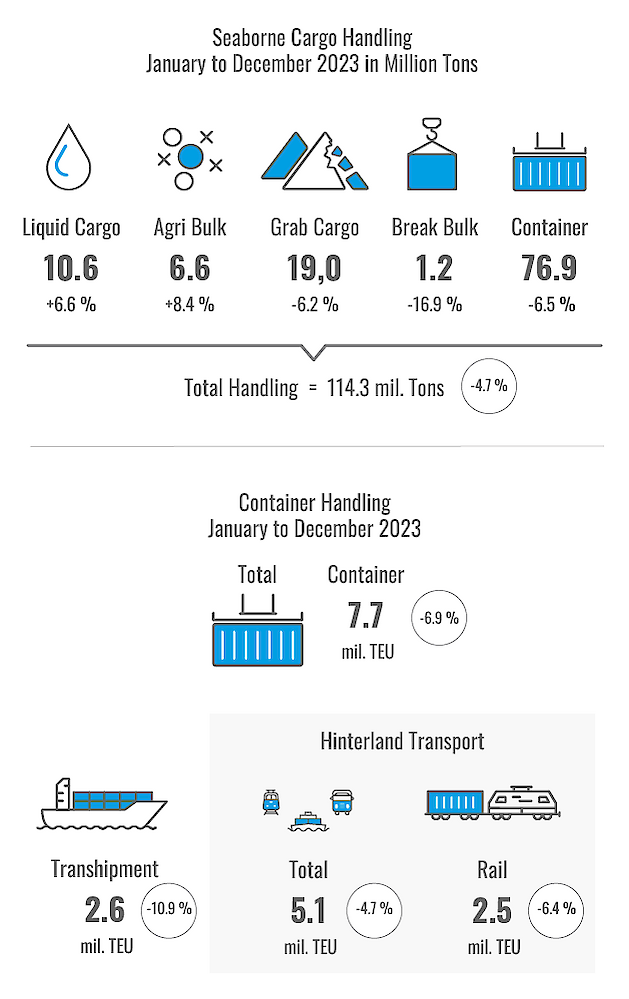

In 2023, the terminals in the Port of Hamburg handled a total of 114.3 million tonnes of goods. Seaborne cargo throughput is thus 4.7 percent below the level of the previous year. Container throughput amounted to 7.7 million TEU, decreasing by 6.9 percent. In the first half of 2023, the decline in container throughput amounted to as much as 11.7 percent compared to the same period in the previous year. “When we look at the development of our throughput figures, we are on the same level as our Northern European competitors and are holding our own well compared to other ports. The decline is primarily due to the difficult geopolitical and economic situation that we all are facing,” explains Axel Mattern, CEO of Port of Hamburg Marketing.

Stable bulk cargo throughput ensures security of supply

Bulk cargo throughput, which is important for the supply of the German economy and industry, remained stable in 2023 at 36.2 million tonnes (-0.2 percent compared to the previous year). With an increase of 8.4 percent to 6.6 million tonnes, the agribulk business in particular recorded strong growth. In the area of liquid cargo, companies increased throughput to 10.6 million tonnes. This equates to a gain of 6.6 percent compared to the previous year. Conversely, the throughput of grabbable cargo fell by 6.2 percent to 19 million tonnes. This was due to reduced power generation from coal as well as an inspection at a steelworks connected to the Port of Hamburg.

Record level of USA traffic

USA traffic continued its positive development of the previous years. In total, 653,000 TEU were handled in 2023 with what has become the Port of Hamburg’s second strongest trading partner. This corresponds to a gain of 8 percent compared to 2022. Throughput with India also developed positively. In direct traffic alone, 191,000 TEU – 5.6 percent more containers – were handled with the world’s most populous country in the past year. India thus became the Port of Hamburg’s eighth most important trading partner. China continues to lead the list with 2.2 million TEUs handled in 2023.

Hamburg welcomes more large container ships

More container vessels in the “Megamax” class of 18,000 TEU and above called at the Port of Hamburg, continuing the trend towards more large container ships. At 272 vessels, the figure rose by 14.8 percent in 2023. “We are pleased that the number of large container ships calling at Hamburg has increased in the past year. The fact that so many of the world’s largest container ships call at the Port of Hamburg clearly demonstrates the port’s capability and reliability,” notes Friedrich Stuhrmann, CCO at the Hamburg Port Authority (HPA). “At the same time, it underlines the need to keep optimising the infrastructure for these vessels and to ensure the effective maintenance of the Elbe federal waterway.”

The number of calls by large container ships also rose overall. In 2023, 511 calls by ultra-large container ships of 10,000 TEU or more were recorded – an increase of 5.1 percent compared to the previous year. Moreover, the number of very large container ships (8,000 to 9,999 TEU) and “Panamax” container ships (4,000 to 5,999 TEU) at the Hamburg terminals increased considerably (23.1 percent or 36.7 percent respectively). “This year, we will put the first shore-side power plants into operation at the major container terminals. This will enable a substantial reduction in emissions at the berth. In doing so, the Port of Hamburg will expand on its pioneering role in the field of sustainability and shore-side electricity,” says Stuhrmann.

Hinterland traffic proves to be robust

Hinterland traffic to and from the Port of Hamburg turned out relatively robust in 2023, despite the decline in total cargo throughput. With a volume of 5.1 million TEU, a decrease of only 4.7 percent was recorded. Transshipment traffic declined more significantly (2.6 million TEU, -10.9 percent compared to the previous year), after already exhibiting volatility in the past.

Despite operational challenges, such as strikes and poor weather conditions, rail transported a total of 45.6 million tonnes (-3.6 percent) of goods and products via Europe’s largest railway port. In terms of modal split, with a share of 53.5 percent, rail transport is clearly ahead of truck (38.1 percent) and barge transport (8.4 percent).

Container cargo mirrors this trend. In the previous year, 2.5 million TEU were transported to or from the hinterland of the Port of Hamburg by rail, marking a 6.4 percent decline. Rail transport constituted nearly half (49.7 percent) of all containers in hinterland traffic, with road transport representing 47.9 percent and inland waterways making up 2.4 percent.

In 2023, the terminals in the Port of Hamburg handled a total of 114.3 million tonnes of goods.